does cash app report crypto to irs

Cash App does not provide tax advice. You can withdraw your Bitcoin to a personal wallet unlike competing apps.

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Login to Cash App from a computer.

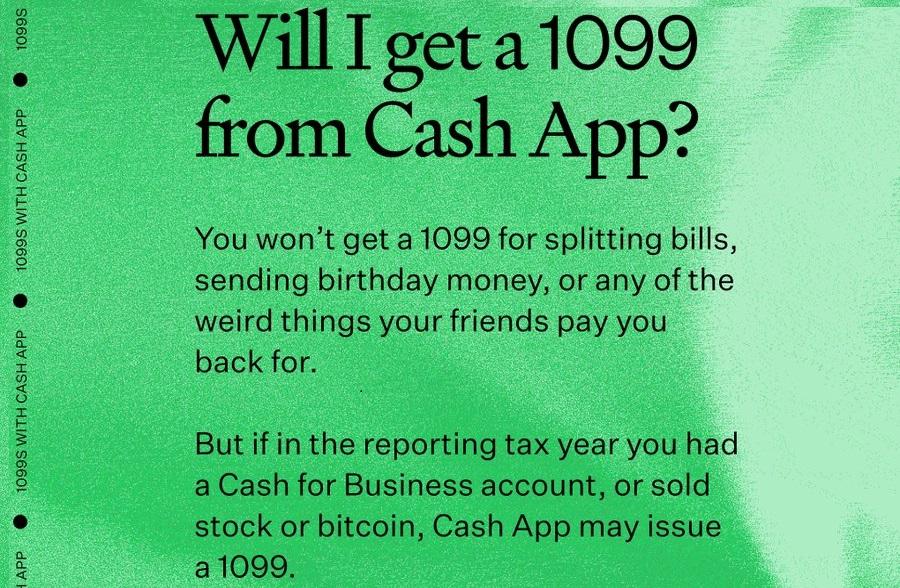

. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send. Cash App is a solid offering that allows you to do a lot of things in a no. The IRS considers cryptocurrenciesand there are many not just Bitcoinas a type of virtual currency.

By Tim Fitzsimons. Yes Coinbase does report your crypto activity to the IRS if you meet certain. Currently PayPal only issues 1099-Ks to users if their account proceeds reach 20000 of gross payment volume and includes more than 200 transactions in any year.

You just need to report on your tax return any income from selling items offering service earnings. Owned by financial stalwart Square. Coinbase will report your transactions to the IRS before the start of tax season.

15th and if Cash app does not file 1099 on your account it means they did not report your activity to the. 475 72 votes. If it is a gift by the legal tax definition you do not have to report it as income.

Do I qualify for a Form 1099-B. One of the simplest ways to buy Bitcoin. If you have a standard non-business Cash App account you dont need to worry about Form 1099-K.

A Bit of Background About Cash App. What Does Cash App Report to the IRS. -First check to see if your.

It is a payment that allows for direct person to person payments just using your. Koinly will calculate your Cash App taxes based on your location and generate your crypto tax report all. Cash app is a mobile application that allows you to send and receive money instantly.

Tap the TRANSFER button on the apps home screen. If you have sold Bitcoin. Below are some troubleshooting tips that may help you resolve the issue.

Coinbase will only report miscellaneous income to the IRS but not your overall gains or losses. Irs Rules On Reporting Bitcoin And. The answer is very simple.

Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. Many new crypto owners are not prepared for recent IRS crypto tax updates. It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App.

If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. However this doesnt mean that you dont need to report your capital gains or. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle.

Click Statements on the top right-hand corner. Heres how you can report your Cash App taxes in minutes using CoinLedger. Cash App will start sending Tax forms at the end of the year by Feb.

Reporting Cash App Income. Once youve uploaded Koinly becomes the ultimate Cash App tax tool. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to.

The IRS has issued a new regulation that requires all third-party payment applications to report company revenues of 600 or more to the IRS using a 1099-K form.

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

New Crypto Tax Reporting Requirements In The 2021 Infrastructure Bill

Yes Taxpayers Must Report Their Cryptocurrency Trading To The Irs Here S How Cbs News

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

The 14 Cash App Scams You Didn T Know About Until Now Aura

Does Cash App Report To The Irs

What Information Does The Irs Collect From Taxpayers On Venmo Paypal Fox Business

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

How To Buy Stocks On Cash App A Step By Step Guide Gobankingrates

Does Cash App Report To The Irs

Cash App File Taxes How To Get Tax Docs And Transaction Records On Cash App For Bitcoin And Stocks Youtube

Venmo Paypal Cash App Must Report Payments Of 600 Or More To The Irs Youtube

Does Cash App Report To The Irs

Do You Have To Report Cash App Payments To The Irs Engineer Your Finances

The 14 Cash App Scams You Didn T Know About Until Now Aura